Arnaud Kleinveld

Участник

This is a journal about an annual recurring event of the US Dollar roll over.

Like every economy, its currency has to cycle. What goes up must come down.

In 2016 I researched a totally random price pattern on CHFJPY major currency pair which lead me to USDJPY and

then discovered something poorly documented going by the name of USDJPY Seasonality.

The journey started with an article on Investopedia about seasonal trends in the Forex Market. From there I expanded

on this subject using an unlimited diversity of information from my experience as IT system architect and electronics engineer.

In my honest opinion the code for success with trading on the Forex market is for each individual unique and a discovery

of how experience, knowledge and personality form a niche within each should aim to excel on the contained subjects.

MQL5 Signal reference https://www.mql5.com/en/signals/709388

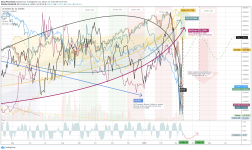

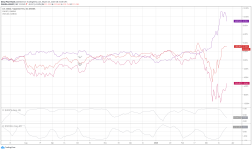

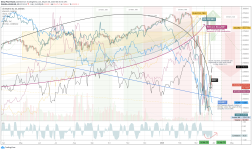

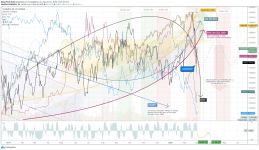

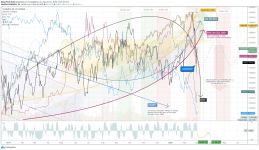

Inter market correlation map of US30 stock market, US Treasury bond yields, DXY, USOil, Gold and Bitcoin. The USD roll over occurs due to a confluence of circumstances which has been showing the same price action patterns for 2017, '18 and '19. Last year was actually skipped by the roll over and is due to take place as I write this piece. For this particular event signals started March '18. Therefor imho I believe it this time is a special edition of the USD roll over and I expect more volatility than ever seen before due to a larger number of circumstances that confluence.

Like every economy, its currency has to cycle. What goes up must come down.

In 2016 I researched a totally random price pattern on CHFJPY major currency pair which lead me to USDJPY and

then discovered something poorly documented going by the name of USDJPY Seasonality.

The journey started with an article on Investopedia about seasonal trends in the Forex Market. From there I expanded

on this subject using an unlimited diversity of information from my experience as IT system architect and electronics engineer.

In my honest opinion the code for success with trading on the Forex market is for each individual unique and a discovery

of how experience, knowledge and personality form a niche within each should aim to excel on the contained subjects.

MQL5 Signal reference https://www.mql5.com/en/signals/709388

Inter market correlation map of US30 stock market, US Treasury bond yields, DXY, USOil, Gold and Bitcoin. The USD roll over occurs due to a confluence of circumstances which has been showing the same price action patterns for 2017, '18 and '19. Last year was actually skipped by the roll over and is due to take place as I write this piece. For this particular event signals started March '18. Therefor imho I believe it this time is a special edition of the USD roll over and I expect more volatility than ever seen before due to a larger number of circumstances that confluence.

Последнее редактирование: